Water/Wastewater

Economic Stability Props up the Wastewater Treatment Market in the Oil & Gas Industry

Sep 06 2011

The global water and wastewater treatment market in the oil and gas industry expects to achieve significant growth once the products in the market become more affordable. End-users that are delaying projects to the third and fourth quarters of 2011 and early 2012 are expected to invest in wastewater treatment solutions when they re-evaluate technology strategies to comply with discharge regulations.

New analysis from Frost & Sullivan (http://j.mp/164tqiQ), Global Water and Wastewater Treatment in Oil and Gas Industry, finds that the market earned revenues of $926.6 million in 2010 and estimates this to reach $1,917.9 million in 2016.

If you are interested in more information on this study, please send an e-mail to Britni Myers, Corporate Communications, at britni.myers@frost.com, with your full name, company name, title, telephone number, company e-mail address, company Web site, city, state and country.

A major focus for refining companies is the increasing water scarcity in refining regions, which necessitates an increasingly strategic approach to water reuse and development of recycling technologies.

“Many regions have significant oil supplies for the short to medium term, but water scarcity is an unresolved challenge,” said Frost & Sullivan industry analyst Ankur Jajoo. “By reclaiming and treating ‘used’ water from the production, refineries can create a self-sustaining water supply with little or no discharge into ponds or deep well injection.”

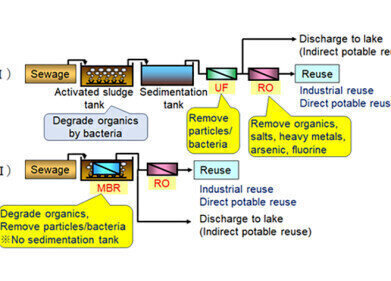

Solution providers are aiming to meet the high demand from refiners to treat the wastewater discharged from the hydraulic fracturing process, therefore enabling its reuse and resulting in a reduction in the amount of freshwater consumed in the refining process. Portrayed areas of growth include reverse osmosis, zero liquid discharge and water recycle/reuse technologies, while expected sustained growth is in disinfection technologies as well as filtration and separation applications. These are standard equipment for the water and wastewater treatment in the oil and gas industry.

Despite the potential of the industry, the economic downturn since 2007 and the increasingly stringent environmental regulations have compelled many refining companies to defer most new projects to allow solution providers to meet the new industry demands.

“Growth in this industry segment can be catalyzed by focusing on the successful development of more energy efficient, compact treatment solutions,” said Jajoo. “Furthermore, innovative applications of new technologies address not only waste removal and physico-chemical applications, but also focus on solutions that encourage water reuse.”

Events

May 23 2024 Beijing, China

May 23 2024 Beijing, China

Jun 10 2024 Algiers, Algeria

Jun 10 2024 Frankfurt, Germany

Singapore International Water Week | Water Expo

Jun 18 2024 Singapore