Water/Wastewater

Demand Spike for Emergency Process Water Set to Double Mobile Water Treatment Market Revenues

Jul 29 2011

Escalating demand for high-purity water in industrial and potable applications has triggered growth in the world mobile water treatment market across both mature and emerging economies. Mobile water treatment systems offer purified water for a short term in emergencies, ensuring that production cycles are not hampered. The need for emergency responses in instances, such as plant downtime, industrial crisis, facilities maintenance, and drinking water shortages, is steadily increasing. The world mobile water treatment market exhibits significant growth, creating fresh opportunities and developing new market segments.

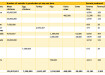

New analysis from Frost & Sullivan (http://j.mp/164tqiQ), World Mobile Water Treatment Market, finds that the market earned revenues of $425.7 million in 2009 and estimates this to reach $895 million in 2016.

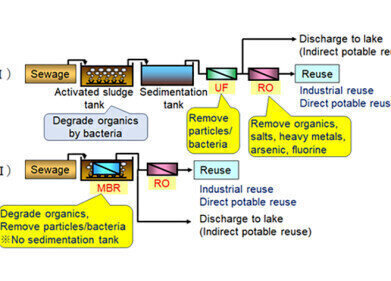

“As funding becomes more available, demand for mobile water treatment systems will likely increase,” said Frost & Sullivan Industry Analyst Pritil Gunjan. “With improved technology, such as reverse osmosis (RO) and electrodeionisation, trailers need not be taken back for regeneration and refurbishment, thus reducing overall cost and chemical effluents.”

Although the outlook for the market looks upbeat, there are some challenges clouding its landscape. The economic downturn had discouraged capital investments. Governments worldwide and industries have postponed investments in the water treatment sector due to force. This has caused the world mobile water treatment systems market to grow at a slightly restrained rate.

Huge capital investments and lack of visibility on return on investment (ROI) hinder penetration into new markets and restrain expansion of fleet size. Significant capital investments are required for owning or expanding fleet size of rental mobile water treatment units. Each unit costs more than $250,000 to $300,000, with no guaranteed break-even period. Thus, this limits the market size. Price sensitivity among end-users is another issue curtailing market progression.

Municipal end-users facing budgetary constraints are reluctant to purchase or rent mobile equipment due to their hefty prices. Intense competition in these markets is forcing end-users to cut service costs to remain competitive. High barriers to entry characterize the market, as a handful of large companies dominate the scenario. This is posing a serious threat to small- and mid-sized companies that have neither the financial wherewithal nor the resources to handle very large projects.

Considering this scenario, planning efficient capital utilization by growing the existing customer base is critical to earn returns on tied-up investments. Exploring new markets and verticals will guarantee strong revenue growth and reduce idle inventory levels.

The market for mobile water treatment systems has traditionally been limited to the developed geographies, such as North America, South America and Europe; hence, the global emerging regions of Asia Pacific and the Middle East offer huge untapped potential. Most companies are looking at attaining first-mover advantage in these regions.

“Participants in this space must place more emphasis on technological innovations to spur growth in this market,” said Gunjan. “Apart from this, customer support structures and speedy responsiveness to customer needs remain the most critical factors that will trigger successful business outcomes.” www.environmental.frost.com

Events

May 13 2024 Munich, Germany

May 23 2024 Beijing, China

May 23 2024 Beijing, China

Jun 10 2024 Algiers, Algeria

Jun 10 2024 Frankfurt, Germany