Air Clean Up

Market for Chemicals to Treat Air will Grow Faster than Water

May 21 2012

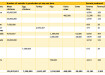

The present world market for chemicals to combat air pollutants is $13.8 billion but will be growing at a healthy eight percent per year over the next five years. The larger ($24 billion) water treatment chemicals market will be growing by six percent per year (real dollars). These are the latest findings by McIlvaine Company (USA) through extracting forecasts from a number of its market reports.

Presently, lime, limestone and ammonia are the chemicals most used for air pollution control. However, the use of other chemicals will be growing at double-digit rates. In the U.S. this segment presently generates $1 billion in revenues. It includes activated carbon, sodium products, bromine, potassium permanganate, hydrogen peroxide, sulfuric acid, amines and certain other chemicals. These chemicals are used for mercury, acid gas, volatile organic compounds, odor, CO2 and microbial capture or destruction.

The U.S. market for activated carbon for air pollution promises to be twice as big as the market in water pollution which is presently 400 million pounds per year. Norit, Calgon Carbon, Albemarle and a joint venture involving ADA-ES are the major players. Bromine is competing with activated carbon. Chemtura, Albemarle and ICl are spearheading the U.S. effort.

FMC has formed an environmental group to supply air pollution, water pollution and remediation products. Hydrogen peroxide is being promoted for NOx control FMC, Tata Chemicals and Church & Dwight have formed Natronix to offer various sodium products for SO3 and SO2 capture. Potassium permanganate is used for odor control. Amines are used for CO2 and SO2 capture.

Lime usage in the U.S. is 20 million tonnes with revenues of $2 billion. Environmental uses are seven million tonnes but with the average price of $150/tonne generate revenues of $1 billion. Air applications now account for 80 percent of the total environmental revenues. Lhoist, Carmeuse, Graymont and Mississippi Lime are quite active in the U.S. market. The Chinese market for lime is presently 180 million tonnes with less than two percent used for air pollution control, but there will be double-digit annual growth over the next five years.

Dry injection for HCl control will boost lime sales in the U.S. Another potential is the use in inhibited oxidation wet SO2 removal systems. The resultant calcium sulfite sludge can be fixed with excess lime and encapsulate toxic metals. This eliminates the need for expensive wastewater treatment. Limestone will continue to be the most utilised reagent for SO2 capture. The largest growth will be in China in the next decade.

Ammonia is used in various forms (anhydrous and aqueous). A popular alternative is the purchase of urea and on-site conversion to ammonia. A huge NOx control program is underway in China. A preference for the urea to ammonia approach has been indicated.

The $24 billion water and wastewater chemicals market will grow at levels well above GDP in the next five years, but its pace will be slower than air. One reason is that non-chemical technologies such as ultra-violet disinfection and electrodeionisation are taking market share away from chemicals. In the U. S., air chemicals presently represent 78 percent of the total for water. This will increase to 85 percent over the next five years.

Events

May 13 2024 Munich, Germany

May 23 2024 Beijing, China

May 23 2024 Beijing, China

Jun 10 2024 Algiers, Algeria

Jun 10 2024 Frankfurt, Germany