Air Clean Up

European gas and steam turbines market to regain momentum between 2012-2014: estimated revenues of over 2 billion

Sep 08 2011

The western European steam and gas turbines market witnessed an all-time low during 2009-2010. However, it is expected to recover in the medium-to-long term despite the uncertainties pertaining to carbon trading, legislations in the electricity sector and imminent rises in commodity prices.

Orders placed with manufacturers during the buoyant market conditions of 2007-2008 had sustained them during the difficult times. However, these legacy orders have now been fulfilled. New orders are still low in number, but they are anticipated to increase from 2012.

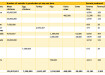

New analysis from Frost & Sullivan (http://j.mp/164trDt), Western European Gas and Steam Turbines Market, finds that the market earned revenues of $473 million in 2010 and estimates this to reach $2,138 million in 2017.

“Electricity demand from both mature and emerging economies and decommissioning of not only old conventional thermal power plants but also nuclear power facilities are the key factors driving the western European gas and steam turbines market,” notes Frost & Sullivan Industry Analyst Pritil Gunjan. “High replacement needs across the United Kingdom, Germany, France and Italy due to decommissioning capacity and the need to comply with legislation will fuel the demand for both gas and steam turbines in these regions.”

The western European market for gas and steam turbines offers a positive outlook, as it will regain momentum between 2012 and 2014. The prospects for both gas and steam turbines are in line with developments within the power generation industry.

“In addition, other forms of environment-friendly technologies such as co-generation are poised to develop further, contributing to the demand for steam turbines” explains Gunjan

The recent economic uncertainty and global financial crisis are likely to be the key restraints in the short term. Lack of adequate access to credit finance and concerns regarding economic conditions may result in delays of projects coming live as planned.

“Given that Europe commands only 3 per cent of the world’s gas reserves, most of its demand is expected to be met by imports, thereby rising the import dependency of western European countries,” cautions Gunjan “However, recent prospects of unconventional gas-fired plants in Europe and the United States are likely to reduce supply pressure for natural gas in the future.”

With increasing competition in the market, it is important to expand geographically. Focus on technological advances and further expansion across vertical applications will sustain the growth momentum among key equipment manufacturers.

“Attractive growth opportunities in the emerging regions of the Middle East, Africa and Southeast Asia will support market development,” concludes Gunjan. “Moreover, an emphasis on technological improvements such as increased efficiency, syngas, fuel flexibility and carbon capture will drive growth opportunities.”

If you are interested in more information on this study, please send an e-mail with your contact details to Chiara Carella, Corporate Communications, at chiara.carella@frost.com.

Western European Gas and Steam Turbines Market is part of the Energy & Power Growth Partnership Service programme, which also includes research in the following markets: Annual Global Power & Energy Outlook, Global Wind Power Markets and Asia Pacific Power Plant Services Market. All research included in subscriptions provide detailed market opportunities and industry trends that have been evaluated following extensive interviews with market participants.

Events

May 05 2024 Seville, Spain

May 13 2024 Munich, Germany

May 23 2024 Beijing, China

May 23 2024 Beijing, China

Jun 10 2024 Algiers, Algeria